LONDON (ICIS)–European titanium dioxide (TiO2) demand is flat but a near-term seasonal pick up is likely although the fragile economic climate and possible EU carcinogen classification could be limiting factors.

European consumption from the main paints sector is reasonable for the time of year, with minimal sign of any seasonal improvement yet.

However, there is some expectation that demand from the main paints/coatings sector will gain momentum during the spring, although any seasonal pick-up is likely to be tempered by cautious economic sentiment.

Demand could also be impacted by the outcome of the regulatory (Reach) committee of the European Commission’s imminent vote on whether TiO2 is to be classified as a category 2 carcinogen when inhaled, following the European Chemical Agency’s (ECHA’s) recommendation in September 2017.

If this classification were to go ahead, then TiO2 buying and reselling sources suggest that demand into consumer goods is likely to be adversely affected, albeit more mid-to-longer term as it will take time for alternative options to be found.

However, suitable substitutes with the same performance and quality may not be easy to find, although it will depend a lot on consumer priorities.

Q2 contract price discussions are yet to get under way in earnest, but there are a few early indications that contract prices could stabilise in the second quarter, based on expectation of a seasonal pick-up in demand and a better-balanced market.

There is also talk of possible pulls in either direction in the second quarter.

Some customers expect further downward price pressure in the second quarter if the market remains slow and availability stays good.

By contrast, firmer upstream costs, an expected seasonal increase in demand and stronger price initiatives in other regions could affect price sentiment in Europe in the second quarter.

However, one trader questioned whether there would be enough of a seasonal pick-up, in view of the fragile economic climate, to justify any Q2 price rises.

Much depends on how demand from the main downstream paints sector and availability pans out, as well as the degree of competition from import sources.

While imports from China are readily available in Europe, there are suggestions that these are not as competitive as before.

European players are closely monitoring Chinese price developments, particularly in view of main Chinese supplier Lomon Billions’ price increase announcement of $100/tonne for exports with effect from 12 February, amid firmer upstream costs and margin related reasons.

The European market is well supplied for standard grade TiO2.

One supplier in Europe apparently has ample sulphate-based TiO2 stocks and it is keen to shift volumes, which is leading to some downward pressure on spot prices.

TiO2 spot prices are being placed at €2,400/tonne FD (free delivered) end user in some cases but this view was not widely confirmed.

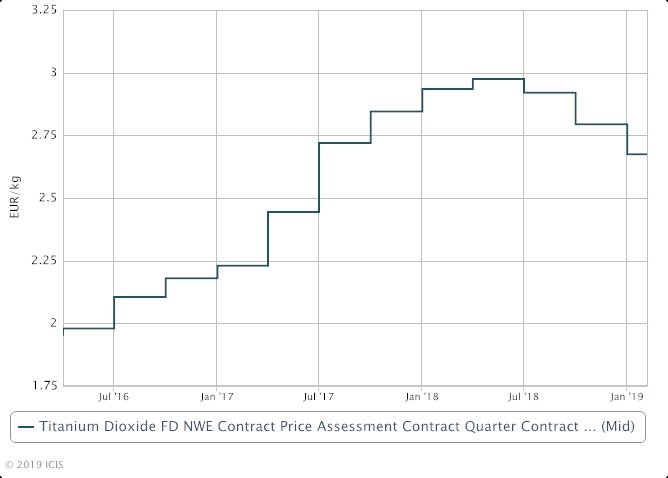

European TiO2 contract prices in the first quarter were assessed at €2.55-2.80/kilogram (KG) FD NWE (northwest Europe), down by €0.10-0.14/KG from the previous quarter.

The Q1 2019 price drop in Europe marked the third consecutive quarterly price reduction, amid lengthy supply and reduced activity.

This is in contrast to the sizeable and successive price hikes from the second quarter of 2016 to the second quarter of 2018, when the market was tight and demand was healthy.