Russian market of Titanium Dioxide pigment is believed to be close to 82k MT/ann. The only local producer Crimean Titan – affiliate branch of Titanium Investments company – produced about 75 kMT/ann in 2016.

The plant which is located in the town of Armyansk uses Sulfate technology.

More than half of pigment produced in Armyansk goes for export: in 2017 Russia exported about 42 kMT of pigment which was 6% higher against previous 2016.

TiO2 is used for production of coatings, polymer processing, paper and personal care products.

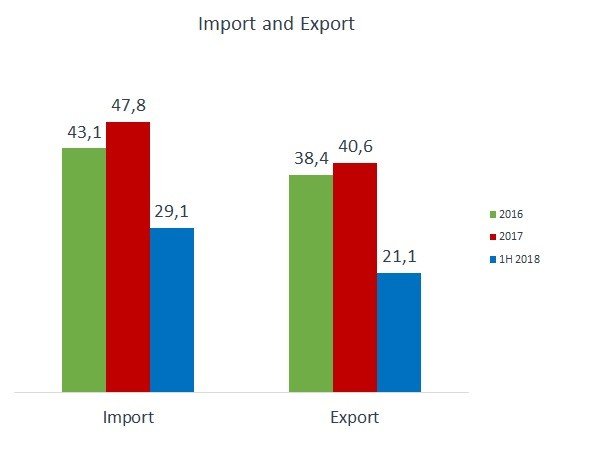

The consumption is only partly satisfied with the local production: the importation plays an important role for all the consumers. In 2017 Russia imported 48 kMT of TiO2, 11% higher than a year before. In the first half 2018 both export and import of Titanium Dioxide increased:

2. Exportation Geography

Titanium Investments Affiliate Branch – Crimean Titan is making steady and persistent efforts to increase the exportation. The exportation volumes went up 6% compared to 2016 and the exportation geography covers 48 countries:

3. Importation

Russian industrials continue buying the imported Titanium Dioxide by two reasons. First Crimean grades do not meet all the diversity of quality and grades. Secondly the growing exportation efforts of local producers make the end users to look for the spare supplier for the emergency zero stock cases.

The biggest exporter country is China but all together the Western high quality grades dominate over the Chinese grades.

The Chinese producers compete in some cases with Crimean grades though Russian customers still prefer to buy Crimean considering it’s quality to be more consistent. Indeed not all the Chinese producers offer the pigment in a strict accordance with the Technical Data Sheet. Some producers start from the price desired by the customer and after getting the customer’s price wish they offer a sample of product available at the desired price. Then instead of concrete technical parameters they write in TDS: “according to the sample”.

What happens then when the contact person from the producer’s side is changed and nobody remembers what was the sample?

Among the producing groups Chemours and Kronos cover nearly half of importation volumes:

4. Price Development

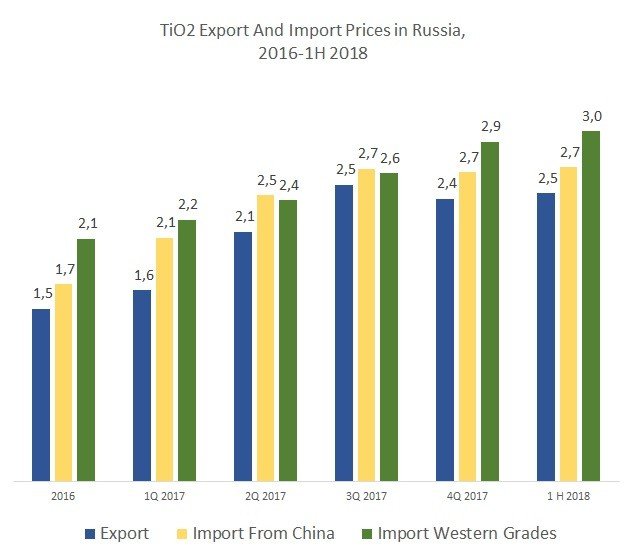

The prices started growing in the end of 2016 and the growth continued till the 4th Q 2018. Both importation and exportation prices were growing.

The biggest increase in percentage was concerned the exportation prices, while the importation grades import prices grew slower.

In 2017 the exportation of TiO2 pigment from Russia started to grow and in order to substitute the exported local product the importation also started to grow, especially from China:

5. Crimean Titan – The Stormy Waters of 2017 and 2018

2017 was a tough year for Crimean Titan: raw materials problems, ecological claims, the bankruptcy claim, staff reduction and finally the roof collapsed in August 2017.

Raw Materials

Earlier the plant was buying the raw materials from Irshansky Mining Processing Plant. The latter was rented by the owner of Crimean Titan from the Ukrainian state.

In September 2014 the situation changed and this supply chain stopped functioning – at least officially.

The sources inform that Crimean Titan still manages to import the raw material from Irshansky Mining Processing plant, another tell that Crimean Titan now buys Ilmenite from Shri Lanka.

Escaping Staff

Crimean Titan is a major employer of Armyansk. The staff numbers 4400 people. It wasreported in media the salaries at the plant were at least 30% lower compared to average in chemical industry of Russia. Thus many employees decided to leave the company and the city and moved away to another cities of Russia searching for a new employment with the higher salaries.

Collapsed Roof

In August 2017 the roof collapsed one of the shops on the territory of the chemical plant Crimean Titan. No casualties were reported, reported in the EMERCOM of Russia.

“In a one-story building on the territory of the enterprise of the Armenian branch of LLC Titan investment collapsed structures of the roof on the area about 3,5 thousand sq. m. According to preliminary information, on the work of the company is not affected. “

The Bankruptcy Claim

Russian Bank VTB suited Titanium Investments company who took control over the plan based on unpaid Bank loan. Moscow Arbitrary Court started the bankruptcy procedure in February 2018.

In September 2018 the Head Crimean Administration Sergey Aksyonov claimed that the nationalization of Crimean Titan plant can be considered.

Ecology

The plant was started in 1971. Still it is the biggest Titanium Dioxide producer in the Eastern Europe. It’s technological cycle was supposed not to exceed 30 years. It’s waste storages were exhausted yet in 1990s. Now the neighbor Kherson Area authorities claims the plant is threatening the ecology of the surrounding territories. And not of only surrounding – there were claims of water pollution inside the town of Armyansk itself.

In August 2018 the boil burst. The Sulphur Dioxide leakage from the plant’s waste storage brought down the ecological disaster over the city. All the leaves of all the trees fell down, the birds flew away. The authorities evacuated about 3000 of children out of the city. On September 9th, 2018, the plant was stopped “for two weeks for technical maintenance” as it was officially noted.

6. Tremendous Investment Plans 2020

As the media mentioned in the beginning of 2018 – the owner of Crimean Titan plans to invest 31,2 bln RUR (about 0,5 bln USD) into the construction of a new workshop of the plant. Currently there are 2 functioning workshops, each one of 40 kMT/ann capacity. The new workshop will produce Titanium Dioxide pigment by Sulfate technology, the capacity being 80 + 40 kMT/ann. The start of construction is planned for 2020. The new workshop will produce 4 grades for Coating industry, 3 grades for Plastics and one grade – for decorative paper. The will come to realization provided that the transportation and water supply problems will be solved – the spokesman of Republican government noted.

7. Expectations

Considering the lack of pigment happened in the beginning of 2017 most of traders and end users have prepared to a new season 2018 with a full stock of Titanium Dioxide. Thus no sharp price change was expected during the first months of 2018. Also the long cold winter in Russia also played its game effecting the late start of the season in construction industry which is the main end consumer of pigment.

The future market development in the end of 2018 will depend on many factors.

If the coatings industry in Russia continues it’s growth at the same level as it was reported for 2017 -10,5% -this growth will certainly be the drive for prices going upwards.

The same effect might have the growing demand on pigment in Europe which might limit the volumes remaining for Russia.

But the major effect will be caused by the situation at Crimean Titan and the economic trends in China.

If Crimean Titan continues successfully increasing the exportation and it’s obsolete production lines suffer new emergencies this will lead to deficit of pigment at the market.

Will China be able to make good the deficit – will depend in many extent on the continuation of it’s strict ecological demands and strengthening of its local currency.

On top of that US sanctions might play the important role. If US imposes total export sanctions on Russia the TiO2 end users will need to substitute 9kMT pf pigment which they now get from the USA.