Summary

- Kronos Worldwide, a producer of titanium dioxide, has seen volatile results over the past decade but shows promise with growing revenues and a market cap of over $1 billion.

- Despite a high payout ratio of 280%, the company’s dividend yield may be attractive to investors, especially with prices trending upwards in many markets.

- The company faces risks such as volatile prices for titanium dioxide and fluctuating currencies, and currently a hold rating makes the most sense.

Investment Rundown

Kronos Worldwide (NYSE:KRO) has a long-standing history dating back to 1916 when it first began production in a small town called Fredrikstad in Norway. Here they began producing TiO2, which at the time was the first commercial production of its sort. Since then it has grown into a worldwide business with a market cap above $1 billion currently. The company has seemingly experienced quite volatile results in the last 10 years. In 2017 the company reached over $350 million in net income, a record for the margins. But I think the outlook looks promising as revenues have been growing but now the challenge becomes to expand margins efficiently. The market for titanium oxide is quite small, in 2030 valued at $34 million. But still growing at a CAGR of over 17% from now, I view KRO as a promising play to capture that same growth, but with the p/e sitting quite high still I am hesitant to rate it a buy just yet. A hold rating will be applied instead.

Company Segments

Operating in the materials sector, KRO has throughout its history focused on working with titanium dioxide, a small market perhaps, but one that is growing quickly. KRO has its operations worldwide and serves several different markets. The TiO2 which they produce is made into two different forms, those being crystalline rutile and crystalline anatase.

These products are used for a variety of different markets, mostly in paint to impart brightness and opacity to it. But it’s also used in ink and some cosmetics but also as a feedstock by sulfate-process TiO2 plants.

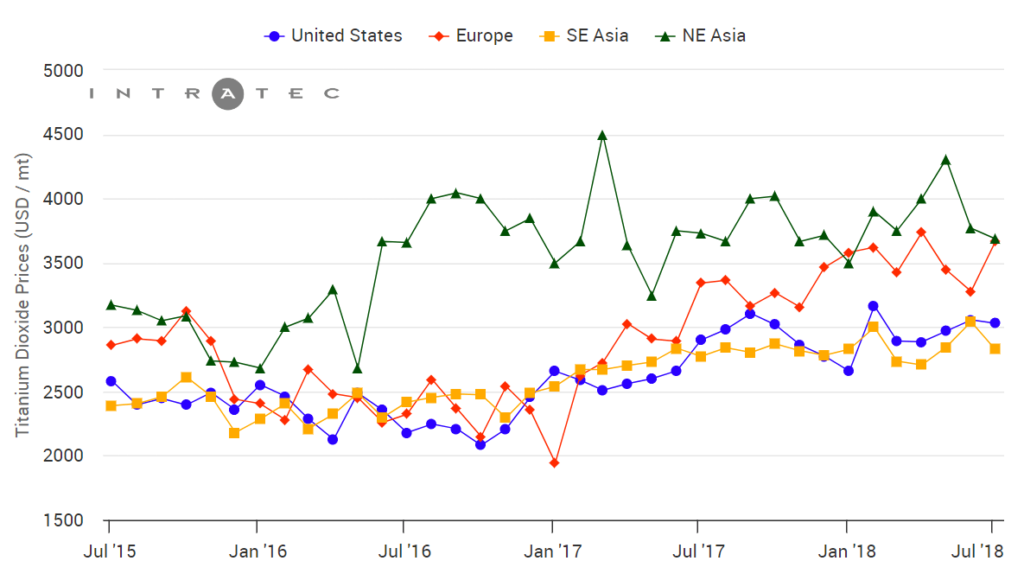

The company is largely dependent on a positive pricing environment for its product to make sure they generate strong profits. When times are tough and pricing low, the company struggles to maintain high margins as we have seen with the rather inconsistent bottom line over the years. What many investors might find appealing about the business instead is the dividend yield it has. Looking at the current payout ratio of 280% one might question how KRO could ever continue to support such a high dividend in the long term. But prices are seemingly starting to trend upwards once again in many markets, creating a solid outlook for the business of KRO.

Markets They Are In

With a worldwide presence, KRO has to maneuver efficiently to capture growth in certain markets when others are placing as high as demand.

Investment Rundown

Kronos Worldwide (NYSE:KRO) has a long-standing history dating back to 1916 when it first began production in a small town called Fredrikstad in Norway. Here they began producing TiO2, which at the time was the first commercial production of its sort. Since then it has grown into a worldwide business with a market cap above $1 billion currently. The company has seemingly experienced quite volatile results in the last 10 years. In 2017 the company reached over $350 million in net income, a record for the margins. But I think the outlook looks promising as revenues have been growing but now the challenge becomes to expand margins efficiently. The market for titanium oxide is quite small, in 2030 valued at $34 million. But still growing at a CAGR of over 17% from now, I view KRO as a promising play to capture that same growth, but with the p/e sitting quite high still I am hesitant to rate it a buy just yet. A hold rating will be applied instead.

Company Segments

Operating in the materials sector, KRO has throughout its history focused on working with titanium dioxide, a small market perhaps, but one that is growing quickly. KRO has its operations worldwide and serves several different markets. The TiO2 which they produce is made into two different forms, those being crystalline rutile and crystalline anatase.

These products are used for a variety of different markets, mostly in paint to impart brightness and opacity to it. But it’s also used in ink and some cosmetics but also as a feedstock by sulfate-process TiO2 plants.

The company is largely dependent on a positive pricing environment for its product to make sure they generate strong profits. When times are tough and pricing low, the company struggles to maintain high margins as we have seen with the rather inconsistent bottom line over the years. What many investors might find appealing about the business instead is the dividend yield it has. Looking at the current payout ratio of 280% one might question how KRO could ever continue to support such a high dividend in the long term. But prices are seemingly starting to trend upwards once again in many markets, creating a solid outlook for the business of KRO.

Markets They Are In

With a worldwide presence, KRO has to maneuver efficiently to capture growth in certain markets when others are placing as high as demand.

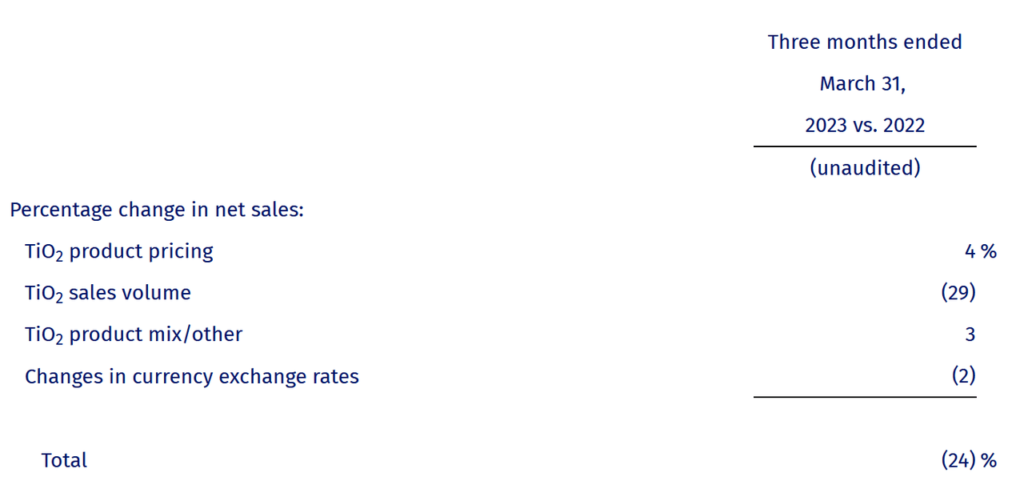

But the revenues results for the quarter were still a beat on estimates as it reached $342 million. With revenues like that, KRO is not trading that richly on a p/s metric, sitting at 0.64 on an FWD basis. Viewing KRO solely based on earnings might be a little unfair as they are likely to remain volatile, as they reflect the condition of the market. But they do tell the story about KRO’s ability to continue having a high dividend.

The cash position is still sitting quite high at $177 million, which can support at least 2 more years of the current dividend before KRO needs to see stronger earnings if they do want to cut the dividend. That places also some risk on an investor and supports why I don’t think right now is such a good time to be buying the stock, and a hold rating makes more sense.

Risks

The most prominent risk that is facing KRO right now is simply volatile and unfavorable prices for titanium dioxide. Seeing as this is the bread and butter of the business there isn’t necessarily something that KRO can do to mitigate and hedge against downturns.

Apart from that, unfavorable and fluctuating currencies could also lead to some quarters resulting in poor bottom line results, or the opposite too. With a worldly market to serve, they are always exposed to these things. Looking at the valuation as well for KRO it’s trading quite high at a p/e of 34, which is far above its historical average of 19. Estimates may suggest that KRO will recover its bottom line very quickly in the coming years, but I am a little hesitant until we see proof.

Final Words

Kronos Worldwide operates in a very niche market where they perhaps haven’t grown into a number one position yet, but with the strong financial performance, I think they could steal more market share. The industry is highly cyclical but right now the prices of TiO2 are on the rise and for coming quarters I think we will continue seeing higher product pricing. But a very bullish signal would be higher shipments, which would reflect the sentiment in the market. For now though, I think KRO stock makes the most sense as a hold.

your source of

Titanium Dioxide

Panzhihua Haifengxin has developed a range of tio2 pigment which is client-oriented and aims to address customer needs in the fields of coating, ink, plastic, paper, and so on.