It was on 08 Jun., 2021, China based and the world’s 3rd largest tio2 manufacturer Lomon Billions announced its 10th price hike since last Jul., nearly consecutive and monthly except for last Nov., amid pervasive concerns that the momentum may loss steam temporarily before the arrival of next peak season in Sep./Oct. Unlike what we’ve seen in the past months, till today there are only 6 out of the rest 39 manufacturers to echo with by raising price as well.

The home market nowadays is fraught with anxieties that the buoyancy the industry has been enjoying might be followed by a decline or even a slump. Sentiments like this manifest themselves in hoarders’ sell-offs, in a vanished market frenzy and speculative purchases. Performances of downstream consumers in the rally of raw materials are divergent, a great deal of small to medium scale enterprises are struggling the cost inflation as the lack of fluidity stands no chance for them to build hedge inventory to counterweight, and their weak bargaining power can hardly help pass on cost inflation to the customers. Their raw material purchases are becoming more and more sales order oriented means they buy only when they obtained orders on the market,

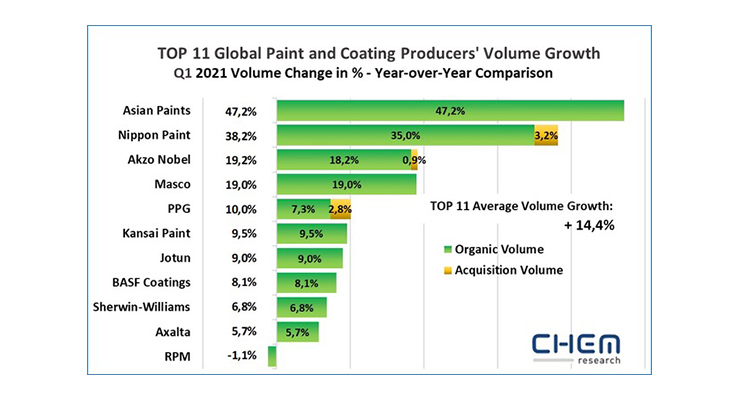

On the contrary, those large scale and leading enterprises were impacted less. According to results of Q1 this year, a majority of them reported encouraging growth of both revenues and profits, some figures are at its record high. All together suggesting those industrial giants are benefiting from the world’s recovery so much so that it can take edge off raw material rally.

In light of this, no one would argue the fact that the demands of leading ones would uphold and consolidate the home market from collapsing. The paints and coatings market in 2021 has seen more frequent price hikes than pre-pandemic years indicating that the leading manufacturers are capable of cost transfer to downstream industries. It is pivotal and decisive to forecast the future trend of tio2 price as well.

On the overseas market, skyrocketing ex-work price coupled with the cost of ocean transportation at an all-time high is weakening the competitiveness of China origin tio2, clients from EU, the Americas, and Africa are complaining that buying from China is no longer an economical practice in their supply chain portfolio, whilst the recovery of western tio2 industry makes it possible for them to buy easily and at an ironically cheaper price for better quality. Export sale is of vital importance as it has long been a driven force to boost the one-year-long price increasing since last Jul. after China firstly coming out of the pandemic with its capacity fully recovered. In the first 5 months of 2021, China exported around 540kt tio2, a YOY growth of 13.01%. Export sales at some leading manufacturers account for 50% or so of their output. A source tells that one flagship enterprise has signed the contracts of all export orders of Jul. that is why they are insensitive in response to today’s subdued market. Admittedly, the resurgent virus spreading in Southern and Southeast Asia, including India, Malaysia, Indonesia who are respectively the No.1, No.5 and No.7 largest importers by country, incurred impacts on export sales of Jun./Jul. However, once these countries ride out of the lockdown and quarantine, consumption would rebound immediately. As the world’s largest supplier of tio2 China exported 1,214.80kt in 2020, accounts for one third of the global consumption outside China, its problem is not lying in demand but price. Supposing the current stagnant status will push Chinese manufacturers to reckon the market in a practical way and revise its offer astutely, export boom ought to return in Sep. in sync with peak season and recoveries worldwide.

Last but not the least, in China’s tio2 industry CLAP ( C: CNNC Huayuan; L: Lomon Billions; A: Aning Iron & Titanium; P: Pangang Group ) established dominance over 60% of the local titanium resources in Panzhihua City, where the verified reserves account for 25% of the world’s total. In the meantime, they captured 35% or so of the tio2 output in China. The existence of such primacy in a stronghold of titanium resources along with their market share of tio2 would have a fundamental influence on market trends. Pangang Group stated they would remain the price of their ilmenite and titanium slag unchanged in Jul. As consequence, it offers no room to price reduction at the manufacturer’s side, from the perspective of raw material cost. We all should keep a close eye on their next move.

Disclaimer: The above article does not purport to reflect the opinions or views of the company.

Always very good insight , Randal. Thank you.