Defying the forces of supply and demand, certain major titanium dioxide (TiO2) producers are seeking to tame the cycle of boom and bust that has been the hallmark of the sector.

Defying the forces of supply and demand, certain major titanium dioxide (TiO2) producers are seeking to tame the cycle of boom and bust that has been the hallmark of the sector.

This is a huge challenge, which surely will be tested in the next major downturn. The point is to put pricing mechanisms in place to structurally change the industry to mitigate both price collapses and parabolic surges.

Key to success will be if enough global producers with big market shares launch this kind of stability mechanism, and if enough customers come on board.

Leading the charge, naturally, is the world’s largest TiO2 producer Chemours, which, through its Ti-Pure Value Stabilisation (VS) programme is aiming to provide customers stability of prices along with security of supply.

There are two aspects of this programme. The first is the Assured Value Agreement (AVA) contract, which has prices that can be adjusted every six months based on a world producer price index (PPI).

Using such a PPI makes any price changes “very tangible and transparent”, according to Chemours CEO Mark Vergnano.

Also under the AVA contract, the volumes a customer takes are flexible, based on how much the customer actually needs. Chemours essentially contracts for a share of the customer’s business, and the actual volumes rise and fall with demand.

The company aims to have more than 50% of its volumes under these contracts.

Under the old system, price openers in contracts took place every quarter in North America, and the volumes under contract were fixed.

The second aspect of the VS programme is the flexible (Flex) offering where a customer can buy TiO2 at a set price without a contract, but only if that product is available. Here the customer forgoes stability of supply.

The Flex programme was launched in February in the UK and Brazil, and will be rolled out globally on 1 March.

TRONOX AIMS FOR STABILISATION

Chemours is not the only TiO2 producer seeking to use this type of stabilisation mechanism. Tronox is working on its own initiatives with customers to “dampen margin volatility across the cycle”, said CEO Jeff Quinn on the company’s Q3 earnings conference call in November 2018.

Progress on the initiatives was deferred, as Tronox seeks to close its acquisition of TiO2 producer Cristal, which has met with stiff resistance from regulators. Tronox’s presence with certain large customers would change dramatically if the combination takes place, he noted.

Tronox would aim to get “somewhere in the range of 50% in 2019” under margin stabilisation contracts, said chief commercial officer John Romano on the call.

The typical length of the contracts would be three to five years, he added.

VENATOR EFFORTS

TiO2 producer Venator is also moving towards stabilization contracts, but only with select customers.

“We believe we are on a pathway here to promote stabilisation and a more certain type of planning environment with our customers,” said Simon Turner, CEO of Venator, on the company’s Q4 conference call on 20 February.

“Larger customers… have trended towards custom contracts, which promote both price and volume certainty. And in our larger markets like Europe, that is something we hear from them, and we have an interest in doing. The trend has been to move in that direction,” he added.

However, it is not a one-size-fits-all approach as some customers, especially in areas such as South America and parts of Asia, prefer spot or short-term contracts – some as short as one month, he said.

MARKET SHARES CRITICAL

The success of any price or margin stabilisation initiatives will depend on the producers involved having a certain critical mass of market share. After all, if producers attempting stabilisation contracts are overwhelmed by falling prices when supply becomes long, the efforts are prone to fall short.

It is unclear what combined percentage market share of producers involved in price stabilisation would be needed to make a real difference, but clearly the higher the better. The

same goes for customers that participate in such a system.

Chemours estimates worldwide demand for TiO2 pigment in 2018 at around 5.9m tonnes, of which 60% was for premium performance pigments. Global nameplate capacity is estimated at about 7.5m tonnes, it stated in its 10-K annual report filed with the US Securities and Exchange Commission.

Chloride process–based TiO2 is considered higher quality than pigment produced through the older sulphate-based process.

MARKET SHARES ANALYSIS

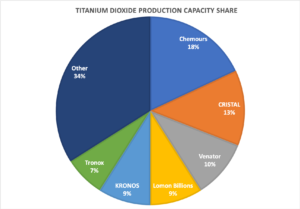

With just over 1.5m tonnes/year of TiO2 capacity – and all chloride-based – Chemours would represent over 20% of total global capacity and a higher percentage of the premium segment.

Major multinational competitors include Cristal, Venator Materials, Kronos and Tronox (in the process of acquiring Cristal). Lomon Billions is the major China-based producer.

If the Tronox/Cristal merger had gone through without any required divestments, the combined company would have had about 18% of global capacity based on 2016 figures, according to a November 2017 Tronox presentation.

Tronox/Cristal combined TiO2 capacity would have been 1.32m tonnes/year, nearing the size of today’s Chemours.

The proposed remedy of divesting Cristal’s Ashtabula, Ohio, plants would remove about 245,000 tonnes/year of capacity, for a “revised” combined capacity of 1.08m tonnes/year.

Tronox’s proposed deal to sell the Ashtabula plants to Venator fell apart by 1 October 2018, and Tronox subsequently announced on 4 December a plan to sell them to INEOS Enterprises if this would satisfy the US Federal Trade Commission (FTC).

The US FTC’s initial decision report released on 14 December 2018 against the proposed Tronox/Cristal merger was heavily redacted when it came to specific company market shares.

The report did provide some TiO2 market share insights. An analysis by the Complaint Counsel’s economic expert witness, Nicholas Hill, cited in the decision, estimated that Tronox and Cristal together would represent about 40% of the North American chloride-based TiO2 market based on 2016 figures.

The report further stated that Tronox/Cristal and Chemours would comprise nearly three-quarters of total North American TiO2 sales.

Of the 831,132 tonnes of chloride-based TiO2 sold in North America in 2017, sales by suppliers other than the multinationals Chemours, Cristal, Venator, Kronos and Tronox accounted for only 0.5% of the share, according to the report.

China’s Lomon Billions sold only 3,000-4,000 tonnes of chloride-based TiO2 into the US in 2017. Major paints companies determined that Chinese chloride-based TiO2 did not meet their quality standards, the report stated.

KEY CHALLENGES

So the key to breaking the cycle of price volatility in TiO2 will be to get enough producers with enough market share to be able to convince enough of their customers to get onto price stabilisation contracts.

If such contracts become the rule, perhaps overall prices will not increase or collapse as much as in past cycles. A natural response would perhaps then be to add capacity

more measuredly rather than en masse to take advantage of spectacularly higher prices.

Getting customers onto price stabilisation contracts is much easier in a rising price environment than a falling one.

In a tight market with rising prices, price stability and assurance of supply is an appealing proposition. Not so much in a long market where customers may not want to get locked into stable prices in the face of declines.

One North American TiO2 buyer expressed scepticism on Chemours’ value stabilisation efforts, noting that a number of customers are “running away” from this.

“It’s just opening the door for the Asian TiO2 producers. The tariffs [on China TiO2] will fall because Trump and Xi Jinping both need a political win at home due to faltering economies. Then the flood of Asian TiO2 will start,” the buyer added.

China TiO2 exports to the US are currently under a 10% tariff, potentially rising to 25% if there is no trade deal.

One major European TiO2 buyer in the plastics sector called the baseline pricing in Chemours’ value stabilization contracts “too high”.

“What we have done is to reduce our dependency with [Chemours]. We have been boosting/validating other options,” the buyer added.

The challenge in breaking the cycle of extreme price volatility is daunting. Producers will make a valiant effort to smooth the cycle and banish boom and bust, but they are fighting against market forces.

is disulfiram approved in canada